Our Exclusive Jewelry Blog And Industry News

Review of White Flash’s New Jewelry Presentation Box

When it comes to buying a diamond engagement ring, most customers expect a certain level of quality in the packaging and presentation of their purchase. After all, you are spending thousands of dollars on a purchase and you want it to look as perfect as possible.

In today’s write up, we are going to do a review of the White Flash’s newly launched presentation box and show you what it looks like in real life. Let’s jump right in…

White Flash Unboxing Video (4+ Minutes Long)

Since the focus of this write up is on the new packaging, I won’t be touching much on the quality of their diamond rings.

But if you are interested in finding out more, check out the Vatche ring I purchased here and the full-fledged review of White Flash here.

White Flash Delivers Your Purchase Via FedEx

Unless you are living under a rock, you probably know that FedEx is a highly reliable and punctual courier service. White Flash delivers your purchase securely via FedEx and the package is always fully insured for your peace of mind.

The package is also double sealed; whereby the jewelry box is placed inside a sealed padded envelope before being set in a medium-sized Fedex box.

If you are staying in the United States, delivery time is usually within 1 or 2 working days. If you are an international customer, the delivery time can vary from 3 to 7 days depending on your location.

In my case, the parcel took about 4 days to reach me from the time that FedEx physically picked up the parcel in Texas.

Overview of White Flash’s New Box Packaging

In the past, White Flash’s packaging only consisted of a diamond ring box and an envelope containing relevant documentation of your purchase via a padded envelope in a FedEx box.

As you can see above, the new black-colored jewelry box is a massive improvement in presentation and offers a certain level of anticipation to see what’s inside. Personally, I felt like I was opening a treasure chest when I lifted the flap for the first time.

The jewelry box is made up of 2 main compartments where the top consists of a foam insert that will hold the item you bought. The bottom part of the jewelry box consists of a pull out drawer where all your documents like your invoice and certificates are placed.

In my case, the layout that you see is for a loose diamond purchase where you will see a display box alongside a diamond gripper and a hearts and arrows viewer. This toolkit (hearts & arrows viewer and diamond gripper) only comes by default when you purchase a loose diamond.

If you are buying an engagement ring, the foam insert will be slightly different and will not include the same items. Instead of a display box containing a loose diamond that you saw in my video, you will receive a solid wood ring box that is lacquered in red and black.

Jewelry Box Has a Hidden Storage Area

If you lift up the foam insert, a hidden storage area within the jewelry box will be revealed. This is a sizable amount of space that you can use to keep other types of jewelry safely away from view.

To give you an idea of how big the storage area is, I can place my entire hand into the box and there is still leftover room for me to move around. If you are someone with a fair amount of jewelry, this box can help you consolidate your storage needs.

I think White Flash has designed this presentation box with a beautiful charm and a practical purpose. At the same time, there is also a strong brand image that resonates with its mission statement.

Layout of Every Component of the Jewelry Box

Here, I want to give you an overview of what you will receive by laying out every component of the jewelry box.

Basically, you will get a grading certificate (top left), tax invoice (bottom left), diamond gripper (center), diamond display box (center), hearts and arrows viewer (center), cleaning cloth (bottom center) and 3 informational brochures (right).

Wrapping Things Up – A Significant Upgrade in Presentation

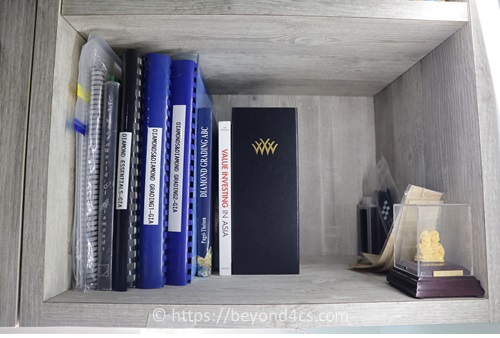

The jewelry box can also be kept as upright storage on a bookshelf.

While nice packaging may not enhance the quality of the product, great packaging does elevate the overall shopping experience and even helps protect your jewelry in storage.

The new packaging that customers will receive from White Flash is sturdily made and designed with practical usage in mind.

But as the saying goes, “It’s what’s inside that really counts”. After all, the diamond ring is what’s being worn and not the jewelry packaging.

And that’s where White Flash shines (literally).

White Flash is one of my favorite places to buy a super ideal cut diamond where light performance and sparkle factor are of utmost priority. Having a beautiful jewelry box packaging that can double up as a storage box is just the cherry on the cake.

Related Articles

Click here to read the full article...Best Places to Buy a Diamond Ring in COVID-19 Outbreak

You are probably aware that the world is undergoing an unprecedented period of time with the COVID-19 pandemic. And like many other businesses around the world, the jewelry industry has not been spared by the outbreak.

Besides temporary closures to physical stores and production workshops, the virus outbreak has caused disruptions to supply chains and logistics.

But what if you need to buy a diamond engagement ring even in a nationwide lockdown situation? In this post, I’m going to provide a list of jewelers that are operational and enable you to safely make a purchase from. (more…)

Click here to read the full article...The Argyle Pink Diamonds Tender

What’s the first thing that comes to your mind when you think of fancy color diamonds?

If you are like most people, I’m pretty sure you willing be thinking about vivid pink diamonds and the beautiful hue they exhibit.

Although diamonds can exist in almost any color hue imaginable, there’s something extremely special about pink diamonds that make them stand out and highly sought after. It’s no wonder that pink diamonds often find themselves in the limelight of record breaking auctions.

In today’s blog post, I’m going to talk about a very specialized niche market in the industry – the Argyle pink diamonds tender. (more…)

Click here to read the full article...105 Best Wedding Blogs You Should Be Reading

If you think buying a diamond engagement ring is an intimidating process (trust me, I know), preparing for a wedding is going to be many times more stressful.

From setting a date, finding a venue, sourcing for wedding decorations to sending invitations, there are loads of things that require careful planning and budgeting.

In an effort to help brides and grooms-to-be prepare for their big day, we have put together a list of the top 105 wedding blogs that are shaking up the bridal space. These are the handpicked cream-of-the-crop selections after weeks of sieving through thousands of bridal blogs on the Internet.

Whether you are looking for wedding ideas or seeking advice on burning questions, these blogs will provide you with handy tips and information to help you turn your dream wedding into a reality. (more…)

Click here to read the full article...Top 60 Diamond Blogs That Rock The Web

If you’re looking for insightful and educational blogs about diamonds, you’ve come to the right place. Here are 60 of the best diamond blogs on the Internet.

As you know, there are literally hundreds of diamond and jewelry related blogs online. But we decided to separate the wheat from the chaff and give you only the cream of the crop.

To make the list, the blogs had to be well designed, up-to-date and/or provide an unique perspective in the content they write.

Whether you are a consumer who’s shopping for a diamond ring or a trade personnel trying to learn more about the industry, these blogs will give you handy tips, insights and information. Check them out below… (more…)

Click here to read the full article...